All Categories

Featured

[/image][=video]

[/video]

Withdrawals from the money worth of an IUL are commonly tax-free up to the quantity of costs paid. Any type of withdrawals above this quantity might go through taxes depending on plan framework. Standard 401(k) contributions are made with pre-tax bucks, decreasing gross income in the year of the payment. Roth 401(k) payments (a plan feature readily available in most 401(k) plans) are made with after-tax payments and after that can be accessed (revenues and all) tax-free in retirement.

Withdrawals from a Roth 401(k) are tax-free if the account has been open for a minimum of 5 years and the person mores than 59. Assets taken out from a standard or Roth 401(k) before age 59 might sustain a 10% penalty. Not specifically The claims that IULs can be your own bank are an oversimplification and can be misdirecting for numerous reasons.

You might be subject to upgrading associated health and wellness concerns that can impact your recurring expenses. With a 401(k), the cash is always your own, consisting of vested employer matching no matter whether you stop contributing. Risk and Guarantees: Most importantly, IUL policies, and the money value, are not FDIC guaranteed like basic checking account.

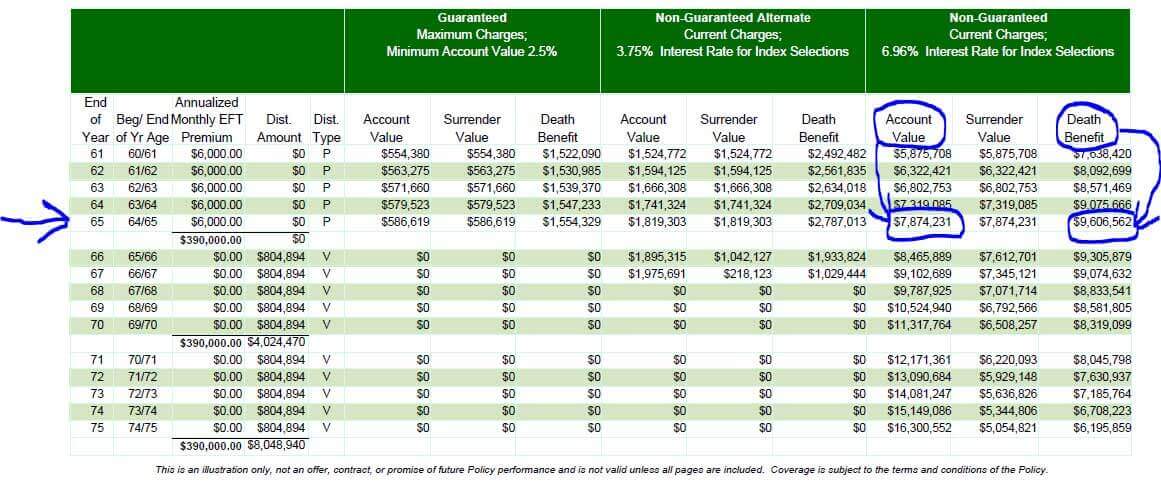

While there is commonly a floor to stop losses, the growth potential is capped (indicating you may not completely profit from market growths). Many professionals will concur that these are not similar items. If you want survivor benefit for your survivor and are worried your retired life savings will not suffice, then you might wish to take into consideration an IUL or various other life insurance coverage item.

Certain, the IUL can provide access to a cash money account, however once again this is not the primary purpose of the item. Whether you desire or require an IUL is an extremely private concern and depends upon your primary financial goal and goals. However, below we will certainly attempt to cover benefits and constraints for an IUL and a 401(k), so you can further define these items and make a much more informed choice concerning the very best means to take care of retired life and looking after your loved ones after death.

Index Universal Life Insurance Dave Ramsey

Lending Prices: Loans versus the policy accrue interest and, if not settled, minimize the death benefit that is paid to the recipient. Market Engagement Limitations: For a lot of policies, investment growth is linked to a securities market index, yet gains are usually topped, restricting upside possible - indexed universal life insurance complaints. Sales Practices: These policies are commonly offered by insurance policy agents who may emphasize benefits without fully explaining costs and risks

While some social media pundits recommend an IUL is an alternative item for a 401(k), it is not. Indexed Universal Life (IUL) is a kind of irreversible life insurance policy that likewise provides a cash money value element.

Latest Posts

State Farm Iul

Index Universal Life Insurance Companies

Indexed Universal Life Insurance For Wfg Agents